Buttermilk Falls Inn & Spa, a long established Hudson Valley resort, wedding venue, and tourist destination, is the subject of a foreclosure action following an alleged default on a short term commercial loan, according to court filings in Ulster County Supreme Court.

The action was filed in late December by private lender BCG Lending LLC, which alleges that the property’s owner, Robert L. Pollock, failed to repay an $838,000 bridge loan when it matured on December 1, 2025. The filing comes as the inn’s proposed expansion plans remain stalled and as town officials face public scrutiny over allegations of impropriety, including accusations of wrongdoing in connection with Buttermilk’s development approvals in Marlborough.

A Bridge to Nowhere

Court documents indicate the loan was executed in December 2024 and carried an interest rate of 11 percent, consistent with short term bridge financing typically used to cover interim development costs. BCG Lending alleges the loan remains unpaid and that, under the terms of the agreement, the interest rate increased to 24 percent following default, amounting to roughly $16,700 per month.

The lender is seeking appointment of a receiver to manage the property’s revenues, including income generated by Henry’s at the Farm restaurant and the on site spa. The foreclosure filing also notes that the property is already encumbered by more than $7 million in prior mortgages held primarily by Ulster Savings Bank and Wallkill Valley Federal Savings & Loan.

As of this week, no formal response to the foreclosure complaint has been filed.

Expansion Plans and Regulatory Review

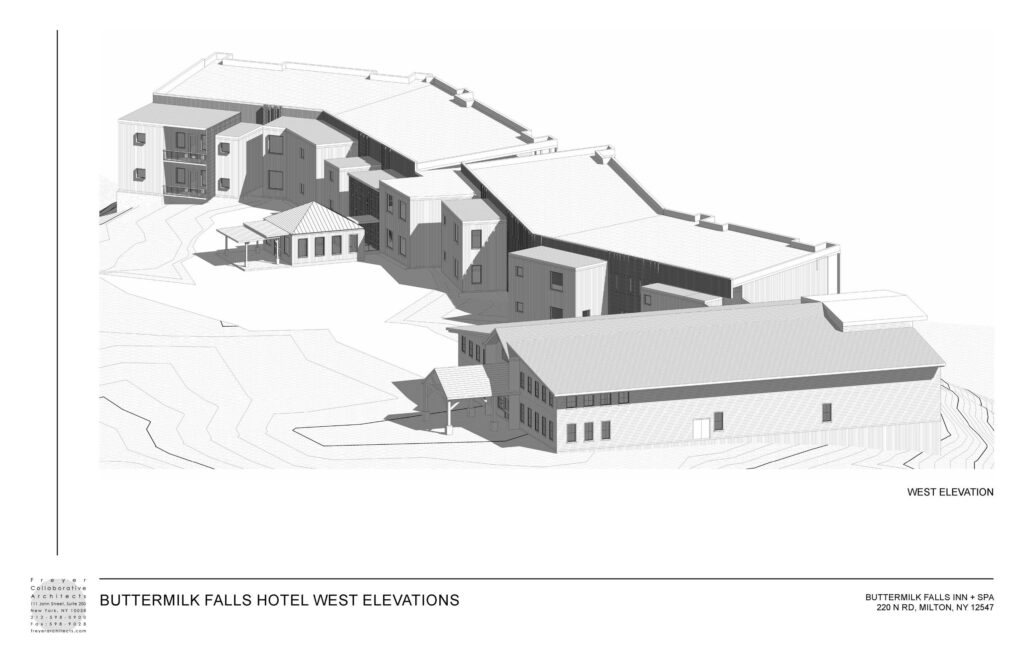

The financial dispute follows several years of proposed expansion plans at the 75 acre riverside estate. In 2023 and 2024, Pollock submitted applications seeking approval for a significant redevelopment that included a 65 room hotel, a 300 seat banquet facility, and 35 guest cabins described in filings as “treehouse” style accommodations.

The proposals drew review from the Marlborough Planning Board, which raised concerns related to traffic impacts along North Road and development on steep slopes near the Hudson River. While no formal estimate has been released, the planning process required engineering studies, architectural designs, and legal work typically associated with large scale projects.

Despite the project’s scale, the Planning Board granted the development what is known as a “Negative Declaration,” ruling that the proposed plans “will not have a significant effect on the environment” and waiving the need for the lengthy and expensive environmental impact statement. The process is designed to protect communities from negative environmental impact, and a negative declaration is unusual in projects of this scale. The Planning Board’s decision considerably fast-tracked the planning process and the development was approved last year.

The dispute coincides with a controversial change, announced earlier this month, to Buttermilk Falls Inn’s gift card policy. The announcement drew concerns that their unused credits would expire before they could be applied to the resort’s advertised renovations.

Political Context and Allegations

The foreclosure action coincides with a broader political controversy involving town leadership. In late 2025, allegations surfaced that Town Supervisor Scott Corcoran and his brother, Code Enforcement Officer Thomas Corcoran, received improper benefits from local developers, including use of facilities at Buttermilk Falls Inn while the property was seeking approvals.

Ulster County Legislator Joseph Maloney characterized the allegations as a “quid pro quo” and stated that his investigation, which also examined separate claims involving alleged embezzlement of Marlborough Youth Football by Thomas Corcoran Jr., was referred to the New York State Attorney General, State Comptroller, and State Police.

Both Scott and Thomas Corcoran have denied wrongdoing. Supervisor Corcoran has stated publicly that he paid for services used at the inn and has receipts to support that claim. He has not publicly disclosed those receipts. Thomas Corcoran has described the allegations as politically motivated.

Broader Implications

Pollock owns multiple commercial and residential properties in Marlborough, including Frida’s, a local restaurant and coffee shop that has closed after multiple attempts to operate. Town records also show Pollock has proposed a new mixed use commercial development in Milton’s town center.

Marlborough Deputy Town Supervisor Gael Appler Jr. is reportedly involved as a contractor on that project. Appler has denied working with Pollock. In October 2025, Appler was appointed by Supervisor Corcoran to oversee the internal inquiry into the allegations of impropriety by Thomas Corcoran Jr. as Code Enforcement Officer. Appler has since been appointed to fill a vacant seat on the Town Board.

With foreclosure proceedings underway and interest accruing, the future of Buttermilk Falls Inn remains uncertain. If the matter is not resolved through refinancing or sale, senior lenders could pursue additional legal action.

Editor’s note: This story has been updated to include a denial provided by Gael Appler Jr. after publication.

Leave a Reply to James ChurchillCancel reply